Fishing for Profits

July 20th, 2023

How New York’s Amerra Capital Came to Dominate Mediterranean Aquaculture

- Money manager with mediocre performance eyes big pay day from aquaculture

- Amerra seeking to raise more capital before selling stake in Mediterranean fish farmer

- Amerra shifted into private equity from private debt amid failures and fraud accusations

- Aquaculture company meeting resistance from local communities in Greece and Spain

- Fish farm expansion demonstrates industry conflict between sustainability and scale

- Expansion plans could be derailed by debt and financial viability after inflation spiked

By Michael J. McDonald

There wasn’t much to distinguish Amerra Capital Management as a money manager after it was founded in 2009.

The New York-based firm’s specialty was providing credit to commodity producers in the Americas, and reports show it racked up mostly subpar returns for its investors. In fact, Amerra may have earned more notice for its legal entanglements, allegedly enabling a bank fraud in 2016 that sent three cocoa trading company executives from New Jersey to prison and getting sued in 2021 after the collapse of an organic grain buyer it helped launch in Minneapolis.

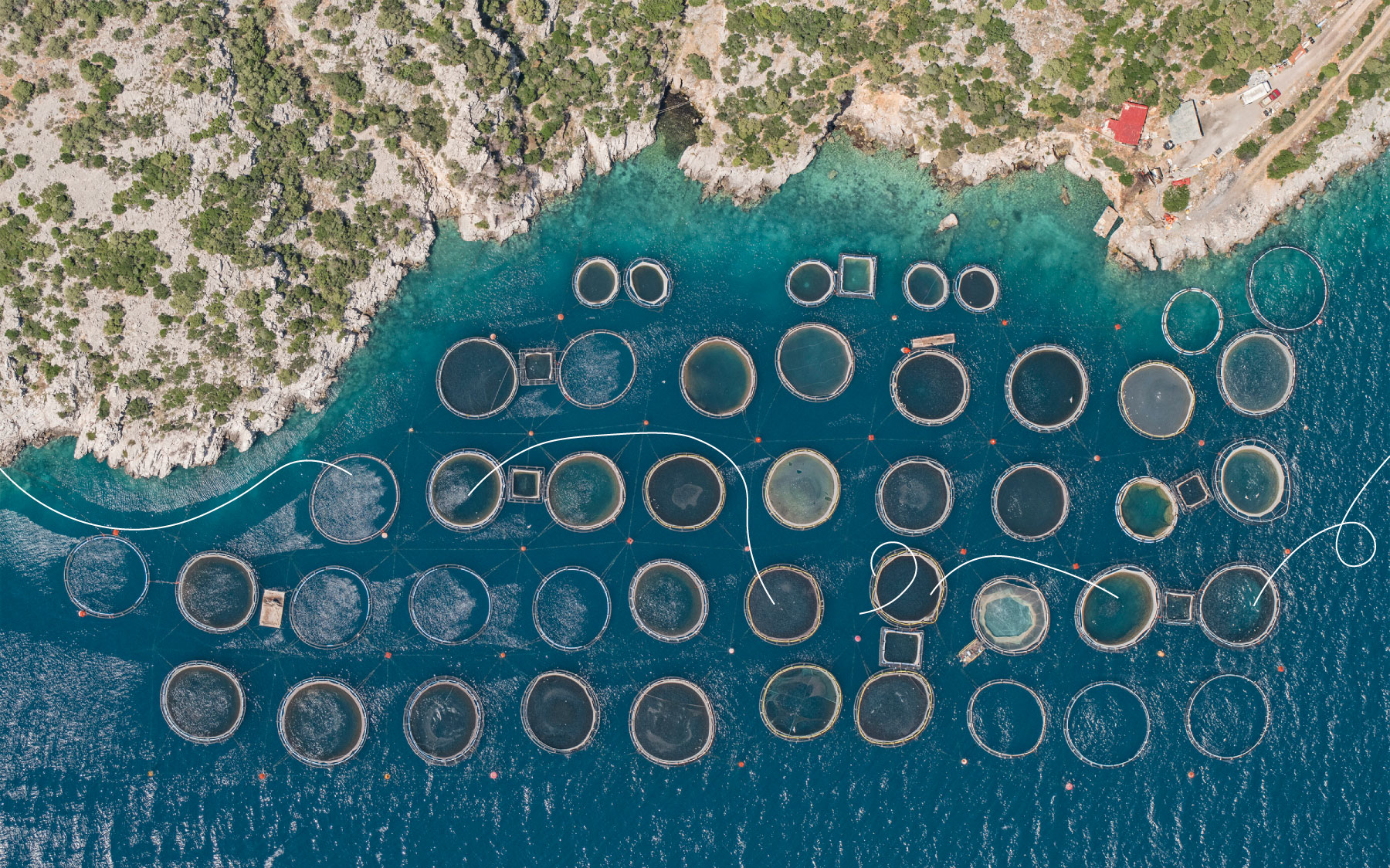

Yet, in the last five years, the firm has emerged as a key player behind one of the Mediterranean’s most important industries, helping spearhead the consolidation of companies in Greece and Spain in 2018 to create the region’s biggest fish producer. Amerra, working with a sovereign wealth fund called Mubadala Investment Company, now controls an entity called Avramar that produces more than 70,000 metric tons of sea bass, sea bream and other white fish a year, enough to meet about a third of annual seafood demand in the US.

The investment was initially welcomed by government officials, particularly in Greece, which was struggling to revive its ailing fish farming industry. It was also considered by some observers at the time as potentially a benchmark deal that might attract more private equity investors looking to consolidate what is, outside the salmon farming business, a largely fragmented, $290 billion global aquaculture industry facing demands to meet an ever-expanding consumer diet for healthier protein1.

However, the deal has come under increasing scrutiny amid reports that Avramar is struggling to service its considerable debt amid skyrocketing input prices and weakening demand for its product. Still, Amerra and its partner Mubadala have big plans for the venture. According to a person familiar with the matter, Amerra has been soliciting investors to raise $40 million for another private equity fund vehicle to finance efficiency and output improvements at Avramar’s operations. Amerra ultimately wants to sell Avramar through an initial public offering on the Oslo Stock Exchange, converting it to a publicly traded company by 2026, the person said.

“What they want to know is, how do you increase cash flow and double or triple your money in five to seven years,” says Jim Baker, executive director of a financial industry watchdog group.

If they can ride through the current market turmoil, an IPO could mint riches for Amerra and Mubadala, which is based in the United Arab Emirate and oversees about $284 billion of assets for the government of Abu Dhabi2. Oslo’s exchange is home to a handful of massive salmon farming companies that have industrialized and consolidated the $15 billion business as demand surged globally over the last two decades, providing a template for converting Avramar’s enterprise value into financial gains.

Representatives for Amerra and Mubadala did not respond to emails seeking comment.

Oslo’s Fish Farming Giants

| Annual harvest | Annual revenue | Market Cap | |

| Mowi | 464,000 metric tons | $5.3 billion | $8.8 billion |

| Leroy Seafood Group | 210,000 metric tons | $2.5 billion | $3.1 billion |

| Bakkafrost | 98,000 metric tons | $1 billion | $4.5 billion |

| Avramar | 75,000 metric tons | $500 million | IPO TBD |

Amerra’s ambitions also reveal a larger conflict that has dogged the aquaculture industry as it has grown to account for about half the seafood currently consumed in the world. The surest way for fish farmers to make money is to scale their operations. But with scale comes greater environmental impact, from the waste produced in crowded floating sea cages where fish are raised, to disease and infestations like sea lice requiring treatment with antibiotics and chemicals.

Farming carnivorous fish like sea bass or salmon also has a huge impact on other species–lesser wild stocks have seen their populations devastated as they have been caught and turned into fishmeal needed to feed the more valued farmed populations. In addition to disease, wild populations, which are already plunging from overfishing and climate change, can be harmed by breeding with weaker, escaped farmed species.

Private Equity Incentives

The industry is aware of these dilemmas, and, inspired by groups like the Nature Conservancy, numerous investors have flocked to aquaculture seeking to fund game-changing innovations like alternative fish feed and vaccinations against diseases. However, it’s a complicated problem, defying quick fixes. This can conflict with the short horizons of private equity investors, which seek to increase the value of assets they acquire and monetize them within 10 years, targeting double digit investment gains for their backers4.

“They’re totally incentivized to do the exact opposite” of what an industry might need in terms of balancing growth and long-term sustainability, says Jim Baker, executive director of the Private Equity Stakeholder Project, a financial industry watchdog group based in Chicago. “What they want to know is, how do you increase cash flow and double or triple your money in five to seven years.”

Even money managers that were established to find solutions to the industry’s deep-seated problems have set high bars for performance. Venture capitalist Aqua-Spark, which backs innovations to reduce aquaculture waste and limit environmental impact, has a goal of producing annual investment returns more than 20%5. 8F Asset Management, which focuses on backing land-based alternatives to problematic open-sea aquaculture pens, set a target of 30% gains when it raised capital in 2017, according to an industry tracker6.

Persisting Concerns

While profitability is imperative, Avramar says fish welfare is a top priority and its embrace of responsible aquaculture practices has been affirmed through certifications from international sustainability groups like GlobalG.A.P., Friend of the Sea, and the Aquaculture Stewardship Council7. In addition to reducing its environmental impact, the company says in reports that it is targeting more sustainable growth by cutting the amount of processed wild fish it uses at farms while maintaining quality and yield8.

Amerra has also told its investors that Avramar established a sustainability committee and last year hired an external consulting firm to formalize its strategy.

“We’ve learned a lot through the years from the salmon industry–technology, genetics, management processing, biotechnologies,” Craig Tashjian, a managing partner and co-founder of Amerra, told Bloomberg TV in 2022. “We’re in the process of building out a large-scale company using those sorts of technical genetic investments and we think that the world will become very dependent on aquaculture to feed itself in the future.”

Still, concerns persist about the fish it produces. The Monterey Bay Aquarium’s Seafood Watch program says consumers should seek healthier alternatives to sea bass and other white fish farmed in open-net pens in Greece, Spain and neighboring countries, citing reports of excessive use of antibiotics by producers in the region. Avramar has said the percentage of antibiotics in its feeds never exceeds 1%9.

Whether Avramar’s sustainability practices become an issue for potential investors is yet to be seen. What is clearer is that Amerra has a tremendous amount riding on its aquaculture bet. Its agriculture lending business might be far larger–Amerra has amassed more than $4.5 billion of commitments since 2009, financing production of commodities like soybeans, sugar, cocoa, and ethanol, according to its website10. But its legal wranglings appear to have undermined investment performance.

The firm showed initial promise when it was founded, raising around $570 million for its second flagship fund, Amerra Agri Fund II, in 2013, followed by Amerra Agri Fund III, which attracted $820 million of capital in 2016. The three founding partners–Tashjian, Nancy Obler, and Pat Morabito–were veterans of commodity credit markets at New York banks and they launched Amerra with support from Australian project finance giant Macquarie Group and hedge fund pioneer M.D. Sass.

Subpar Fund Performance

While data is limited, what is available show the agricultural lending funds producing poor to mediocre performance, with Amerra Agri Fund II delivering annual average returns of around 6% and Amerra Agri Fund III less than 2%. The firm hasn’t raised any additional private debt funds in recent years. While litigation may be seen as the price of doing business, especially for a firm that’s done more than 300 private debt deals in more than 20 different countries, it’s also indicative that some major investments simply imploded.

Perhaps the most high-profile legal entanglement from its agribusiness is a lawsuit a group of banks filed in 2019 alleging Amerra aided and abetted a fraudulent scheme by a New Jersey-based cocoa trading company called Transmar Commodity Group that went bankrupt in 2016. Amerra was the company’s trading partner and a holder of its unsecured debt. Details emerged from Transmar’s bankruptcy proceedings appearing to show Amerra and founder Nancy Obler participated in the fraud.

That the cocoa trading company committed fraud is not disputed–its three top executives entered guilty pleas in New York courts and were sentenced to prison terms. Even a unit of one of Amerra’s original backers, Macquarie Group, which still owns a significant stake in the firm, joined with the banks in the legal action because it also lost money in the bankruptcy. The case is still pending in New York courts after Amerra failed to have all the allegations dismissed11.

Amerra’s first foray into aquaculture also landed it in the middle of litigation, after it provided credit to a tuna farming firm with operations in Mexico that was later accused of trying to destroy a competitor’s business. Both Amerra and its client, Umami Sustainable Seafood, were sued in 2014 for breach of contract, breach of fiduciary duty, fraud, and other allegations12. Claims against Amerra were ultimately dismissed.

While Amerra’s initial focus was raising what are known as private debt funds to finance short-term loans to commodity producers, by 2016 it had decided to expand into private equity, raising capital to buy assets. None of its founders had experience in these markets, so they hired Thor Talseth, an aquaculture executive from Norway, to lead its fisheries foray, and Robert Hodgen, an executive with a background in the animal feed business, to spearhead agriculture deals.

Private Equity Pivot

The upside for Amerra was obvious–it could potentially reap bigger paydays in private equity markets, buying and later reselling companies, as opposed to making short-term loans to commodity producers. With private debt, especially with senior secured loans that mature in less than three years, one of its specialties, performance is at least in theory constrained by interest rates charged.

Amerra raised its first private equity fund in 2016, collecting more than $100 million from investors for an entity called Amerra Agri PE Fund. Investors in this and related co-invest funds included US pension plans at Harvard University-affiliated Mass General Brigham, the biggest hospital system in Massachusetts; Allstate Insurance; energy provider Eversource; Wespath, a financial unit of the United Methodist Church; a Michigan nonprofit called the Kresge Foundation; and the BJC Pension Plan, which is linked to the National Rural Electric Cooperative Association in St. Louis.

Amerra’s Private Equity Funds

| Amerra Agri PE Fund GP LLC | AUM | Investors | |

| Amerra Agri PE Fund LP | $110,664,954 | 52 | |

| Amerra Andromeda Co-Invest LP | $17,340,267 | 2 | |

| Amerra-Andromeda Co-Invest II LP | $33,282,573 | 10 | |

| Amerra-Aquaship Co-Invest LP | $8,127,983 | 3 | |

| Amerra-Pipeline Co-Invest LP | $1,630 | 6 | |

Amerra’s private equity investors either didn’t return emails seeking comment or declined to comment when reached.

With its first fund raised, Amerra acquired control of a Greek producer of sea bass, sea bream and other white fish called Andromeda Group in 2016. Andromeda had been founded in 1998 and was controlled by an Athens-based private equity firm called Global Finance looking to consolidate the industry, which was ailing in the aftermath of the Greek government-debt crisis and economic downturn.

Two years later, Amerra struck a partnership to significantly expand its aquaculture foray. It agreed to work with the sovereign wealth fund Mubadala, which took a 50% stake in Andromeda. The two then successfully bid to buy the firms Selonda and Nireus, which farmed the same species in the Mediterranean as Andromeda but had taken on too much leverage and were forced into receivership. Andromeda then bought a fish feed producer in Greece called Perseus.

The companies were combined into a fully integrated entity renamed Avramar with consolidated revenue of around $500 million a year and more than 2,000 employees. Its assets include 72 fish farming facilities on Greek and Spanish coastlines, 12 fish packing facilities, 10 hatcheries, three processing plants, and three fish feed mills. The initial roll up was so large the European Commission ordered Avramar to divest some assets, which were sold to another private equity firm called Diorasis Capital.

Too Much Leverage?

To excite potential IPO investors, Avramar needs to keep scaling its operations. This may be proving more difficult than expected. According to the Spanish news site El Confidencial, the fish farmer is struggling to meet its debt obligations, the result of surging input costs that led to higher prices for its products and weaker demand. The deal Amerra spearheaded loaded it with debt that is nearly equal to its $500 million of annual revenue, overwhelming the company, the news site reported14.

The news site also said that Amerra and Mubadala have hired an investment bank to try to renegotiate the terms of Avramar’s sizable loans with Greek lenders. Amerra’s top executive disputed the report, and insisted the company’s revenue and operating earnings are up15. However, it is indisputable that interest rates have soared from next to nothing, as has inflation in Europe, creating far more difficult conditions for highly leveraged commodity producers.

The expansion is creating other tensions. In the small, historic town of Calpe, on a section of the Spanish coastline known as Costa Blanca, locals and municipal officials are fighting a plan approved by provincial authorities to let Avramar go forward with a plan to produce an additional 5,000 metric tons of fish a year in dozens of new sea-based, open-net pens. While Calpe is known for its fishing industry, it is also a popular tourist destination, famous for its beaches and salt flats.

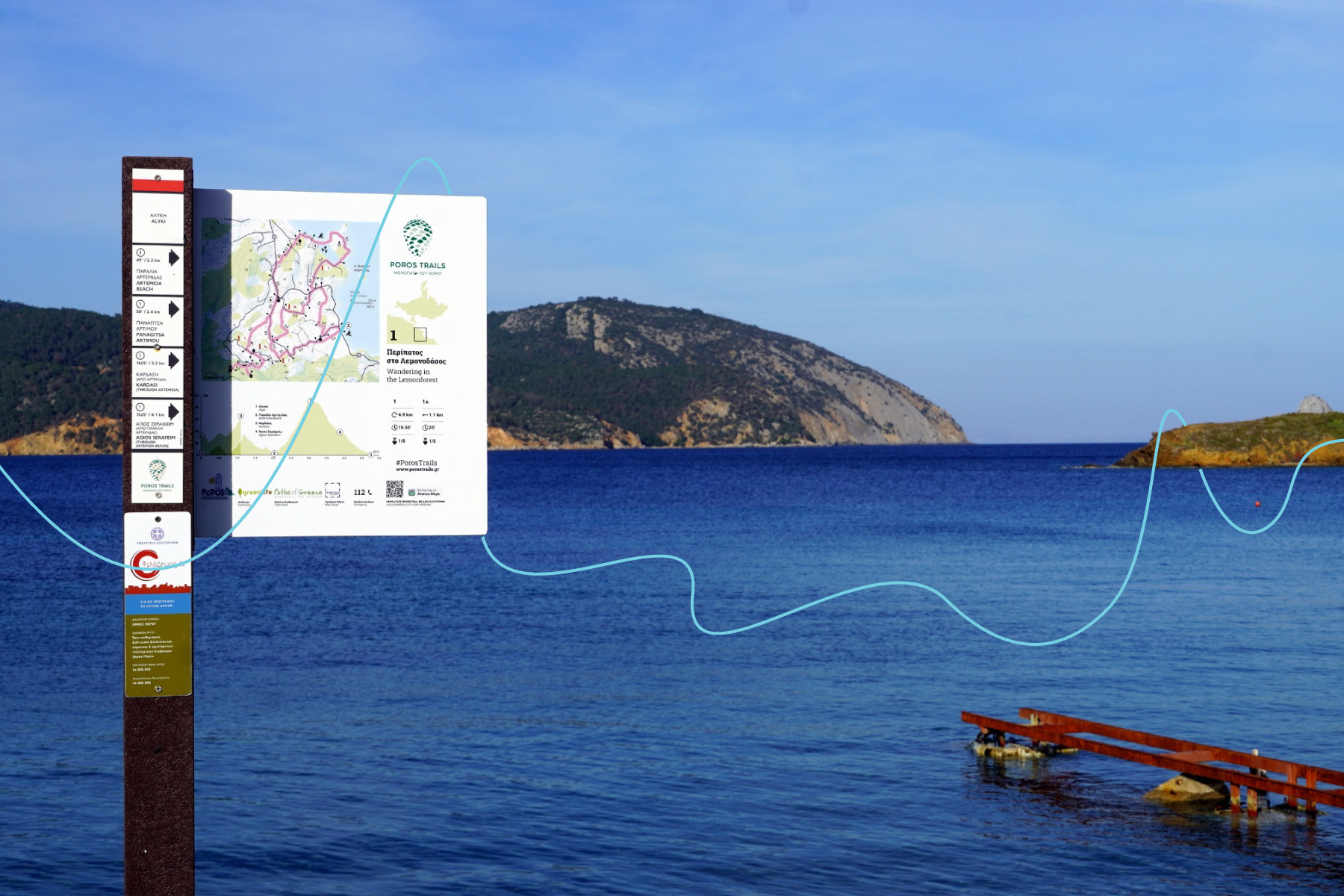

Similar tensions are playing out elsewhere in the Mediterranean. On the Greek island of Poros, which is less than a three-hour drive and ferry ride from Athens, municipal leaders and locals are trying to stop plans to significantly expand what is currently a small fish farm established years ago near the coastline. In addition to the impact on tourism, locals worry about the waste from operations and say the economic impact will be negative despite the promise of new aquaculture jobs.

“We don’t want fish farms on our coast,” Andreas Kaikas, who represents the Tourist Committee of Poros, said in an interview. “Inevitably tourists will no longer come to enjoy the clean waters, the sea and pine forest of the island.”

On the front line managing these conflicts is Thor Talseth, the former Norwegian aquaculture executive hired to spearhead Amerra’s fish farm dealmaking; after the merger was complete, he was appointed as Avramar’s chief executive officer. In profiles, Talseth said he is inspired by the success of the salmon farming industry and understands how aquaculture in the Mediterranean can flourish with the right business plan and management team.

This means not only modernizing production and creating a fully verticalized value chain, from fish egg to plate, as they say, but expanding the value-added products in consumer-friendly formats that sell better in markets like North America where people are less apt to buy whole fish. Under Talseth, Avramar has been both increasing production density at existing locations while reestablishing the firm’s commercial strategy by reorganizing sales and marketing teams and trying to accelerate growth in strategic markets and channels.

“The problem is there are so few seafood companies with the capital available to develop consumer products,” Talseth said in a virtual conference on the seafood industry in 2020.

Success Not Guaranteed

The inspiration from the salmon industry is both telling and troubling. It affirms the centrality of scale in the Amerra strategy, which is perfectly fine from a business perspective. But it fails to account for deeper, longer-term issues plaguing aquaculture. Salmon proved that you could make a lot of money farming fish, but it has also left the industry struggling to find solutions to either make sea-based farming more sustainable or to prove that alternatives, like land-based farming, can work.

“We’ve learned a lot through the years from the salmon industry,”

says Craig Tashjian, a managing partner and co-founder of Amerra.

While the industry is trying to find a way forward to the future, Avramar is trying to enhance profitability and deliver on a much shorter-term plan, an IPO by 2026. And even that is not guaranteed, as its reported debt restructuring showed. In fact, it was lenders running out of patience that led to the demise of Amerra’s other big private equity bet, when it backed an organic grains supply chain company called Pipeline Foods that went bankrupt in 2021.

Lenders to Pipeline Foods filed a case against Amerra last year, alleging the firm deliberately misled them about the financial situation of the startup, causing them to incur “millions of dollars in damages in the form of lost assets, lost revenue, lost business opportunities, increased liabilities and operating costs16.” The case, like others against Amerra, is pending.

Endnote: Since this report was completed, news about further financial troubles at Avramar have surfaced. As of July 11, Euro2day reported that the company has missed its loan repayment obligations to Greek banks and that current shareholders are not willing to continue to lend to them. More should be known about their financial viability in the next month when a required management audit is completed.”

Michael McDonald – Financial Journalist

Michael is a Boston-based writer, ghostwriter and editor with extensive experience producing acclaimed business and financial journalism, with 16 years of experience at Bloomberg. In addition to financial journalism, Michael has experience producing thought leadership and other high-level marketing content for companies and institutional clients.

Michael specialises in bringing clarity to complex and important topics and trends, whether it’s exploring the future of work, the fallout from speculating on financial derivatives, or the inner workings of blockchain and cryptocurrencies. He has worked in newsrooms and, in corporate publications, managed other writers and freelanced. Michael also has extensive experience in public speaking, hosting radio programs, appearing on television, moderating panels and lecturing at colleges.

1 Craze, Matt, “Aquaculture Frontiers, part 5: Financing aquaculture’s potential,’ Spheric Research, December 18, 2019

2 Mubadala Investment Company. “Mubadala – A Sovereign Investor.” Accessed May 19, 2023. https://www.mubadala.com/en/who-we-are/about-mubadala

3 Mowi. “Strong quarter to end a record year for Mowi.” Accessed May 19, 2023. https://mowi.com/blog/strong-quarter-to-end-a-record-year-for-mowi/; GlobeNewswire. “Leroy Seafood Group ASA: Q4 2022 Results.” https://www.globenewswire.com/news-release/2023/02/21/2611706/0/en/Ler%C3%B8y-Seafood-Group-ASA-Q4-2022-Results.html; Hanna Gezelius, “Turnaround in Scotland lifts Bakkafrost first quarter earnings,” Intrafish, Accessed May 9, 2023; https://companiesmarketcap.com/

4 GRAIN. “Private equity sharks take a bite out of the blue economy.” Accessed December 14, 2022. https://grain.org/en/article/6932-private-equity-sharks-take-a-bite-out-of-the-blue-economy

5 Danielle Rossingh, “Aqua-Spark buys stake in undervalued Norwegian biotech company,” Impact investor, November 8, 2021

6 Impact Yield. “8F Aquaculture Fund I.” Accessed May 19, 2023. https://impactyield.com/funds/8f-aquaculture-fund-i

7 Avramar. “Responsible Aquaculture.” Accessed May 19, 2023. https://avramar.eu/story/sustainability/

8 Avramar. “Annual Report.” Accessed May 19, 2023. https://avramar.eu/annual-report/

9 Itsaso Aurrekoetxea Jover, “Follow the fight against the expansion of the Calp fish farm: “What you want to set up here is abominable”,” Lamarinaalta.com, June 29, 2022

10 Amerra. “Private Debt – Selected investments.” Accessed May 19, 2023. https://www.amerracapital.com/private-debt

11 Casetext. “ABN Amro Capital LLC v. Amerra Capital Mgmt.” Accessed July 2, 2022. https://casetext.com/case/abn-amro-capital-llc-v-amerra-capital-mgmt

12 Sapin, Rachel, “Bluefin tuna farmer levels fraud accusation at rival US firm,” Intrafish, April 28, 2020

13 Form ADV. Amerra Capital Management. March 31, 2023 https://reports.adviserinfo.sec.gov/reports/ADV/155860/PDF/155860.pdf

14 Marco, Augustin, “Abu Dabi encarga a Houlihan Lokey el rescate del mayor productor espanol de pescado,” El Confidencial, April 11, 2023

15 Sapin, Rachel, “Avramar CEP dismisses reports of debt struggles, has sights set on North America’s bass and bream prospects,” Intrafish, April 13, 2023

16 Pappas, Leslie, “Pipeline Foods Ch. 11 Trustee Alleges Fraud by Amerra,” Law360, July 28, 2022